REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Want to learn more about implementing seller financing in your real estate business? Be sure to check out SellerFinancingMasterclass.com!

Want to learn more about implementing seller financing in your real estate business? Be sure to check out SellerFinancingMasterclass.com!

When you buy real estate with seller financing, you can structure the terms of the deal so that YOU, as the buyer/borrower, have a highly advantageous deal with as many options as possible.

Granted, the seller's willingness to give you options will, in some ways, limit you. However, you will not have this flexibility when you get a loan from a bank or credit union. There's not even a point in trying to negotiate the terms of your loan with them because that's just not how they work.

When you borrow money from a bank or credit union, they will always use their boilerplate templates, which are written to give them the maximum amount of control and options.

With seller financing, there is much more opportunity to write the loan documents in a way that is fair to the seller but also works to your advantage by giving you plenty of upsides and advantages.

RELATED: Seller Financing Masterclass Review

Of course, your ability to negotiate terms will depend on the seller's flexibility, what they need, how sophisticated they are, and how much they're willing to entertain what you want. But in many cases, if you're the one proposing seller financing in the first place, and if you already have your own documents and deal structure well-planned and ready to go, many sellers won't put up obstacles in the same ways a bank will.

Understanding Your Options

I want to share several different terms you can infuse into your loan documents, to give yourself the kinds of options and control you will never have with a bank loan.

I don't mean to imply that you should always push for all of these things. In fact, it would be highly unlikely that you could get a seller to agree to all of these conditions.

My point is NOT that you should pursue all these things. My goal is to help you see the different cards you can play so you can get creative and pull the right ones out of your back pocket when needed.

This way, you can choose the most appropriate one(s), depending on the seller's willingness to accept. When you understand the seller's wants and needs, you can fine-tune the terms to craft a deal that will work well for you.

Use an Attorney

Important Note: Many of the terms I will discuss here are not standard provisions in the boilerplate templates used by most title companies and attorneys. If you go directly to your closing agent and tell them to draft your loan documents with these provisions, you'll probably meet some resistance. They may even tell you, “It can't be done!” because it doesn't fit inside the neat little box they're used to seeing.

If you choose to use any of these terms in your loan documents, your best course of action is to have your attorney draft them for you. Do NOT try to draft these documents on your own.

When the documents are ready, make arrangements to close with your attorney or whatever title company they recommend. Make sure your closing agent is okay with using your tailored documents ahead of time so you don't encounter resistance or confusion at the closing table. This is a critical time in the closing process when you don't want to hit roadblocks!

First Right of Refusal to Buy Note

Did you know that as the buyer/borrower, you can set up the loan documents so that you have the option to buy your own note from the seller/lender, and you can buy it at a discount?

When I first heard about this, it made my head spin. I didn't realize borrowers could actually buy their own debt, but this really is a thing! And if you understand how and why you can use this, it can give you a huge advantage!

When you include a first right of refusal to buy the note as a borrower, you can more directly control your financing terms. This means that if the seller ever wants to sell the note to another note investor, they have to give you the first choice to purchase the note before they can offer it to anyone else. And if you choose to buy it, they have to sell it to you at a discount from its current balance.

Why would the seller/lender agree to this?

If the lender ever decides to sell the note to anyone, whether you or someone else, they'll almost certainly have to sell it at a discount anyway.

Most notes sell at a maximum of 80% of their current balance, but the exact discount depends on the specifics of the deal. So, it's not unreasonable to ask for a discount; you're just asking them to give you the first shot at buying it before anyone else.

And, if anything, this will make their lives easier because they won't have to search high and low for a note buyer to cash them out. You could do them a huge favor buying it from them!

What would this mean?

If you buy your debt from the seller at a discount, you would effectively owe the money to yourself. Once you owe the money to yourself, you can effectively wipe out the loan because you just paid it off through a backdoor method, and you did it at a cost that was less than the loan balance (because, remember, you bought the note at a discount).

If you had just paid off the note the old-fashioned way by wiring the funds to your lender, you would have paid off the full balance without any discounts. So this clause can potentially save yourself a chunk of change!

Rate and Maturity

Did you know that in a seller-financed deal, you don't necessarily need to pay off the loan with straight-line amortization (equal monthly installments over the entire term of the loan)?

Even though this is how most loans are structured, that doesn't mean you can't explore some alternatives with the seller.

For example:

- What if you made a single payment each year, instead of one each month?

- What if the seller allowed you to defer payments for 12, 18, or 24 months?

- What if you made no payments at all until the loan's maturity date?

- What if you made no payments until the property was generating enough revenue to make these payments?

- What if the seller agreed to a 120-month (10-year) note with 0% interest and no payments until the maturity date? With this arrangement, there would be no amortization because no payments would be required until the single, final payment, where you pay off the entire loan.

These arrangements might be unusual (they are). But depending on what kind of property you're buying, how long you plan to own it, and how you expect to make a profit from it, it could be worth exploring this concept or some rendition of a non-amortizing loan that lets you keep your money in your pocket for a longer time, without any interest.

The seller may or may not be willing to entertain these terms, but there's no rule saying you can't broach the subject and explore what alternatives they might be open to.

The bottom line is that if the seller is okay with waiting longer to receive the bulk of their money, it's usually in your best interests to hold onto your cash as long as possible. Especially if it doesn't cost you anything extra to wait longer.

Step-Up Interest Rate Plan

Most people think of a fixed interest rate as a static number that stays the same throughout the life of a loan. But there's another arrangement known as the step-up interest rate plan, where the interest rate can be set to change as the loan approaches maturity.

For example, the interest rate could change like this:

- 0% for year 1

- 2% for year 2

- 4% for year 3

- 6% for year 4

- 8% for year 5

An arrangement like this would allow you to pay no interest during the period of your amortization schedule when interest is the most expensive.

Better yet, if there is no pre-payment penalty, you could pay down as much of the loan as possible during these earlier years so that when interest does kick in, you'll pay interest on a much lower balance.

If you have to pay interest, it's better to pay it later rather than sooner!

No Personal Guarantee

One of the most buyer-friendly terms to insist on is NOT having to personally guarantee the loan.

This ensures that if things don't go as planned (if you cannot pay down the loan as agreed), the seller's recourse does not extend beyond the project collateral.

In other words, your personal assets will remain out of reach of the seller, which limits your risk to the investment itself.

Of course, it would be unfortunate to lose the property after making whatever principal and interest payments you have made to date. Still, it's far better to lose only the property than have the lender come after your personal assets, too.

In my opinion, this is one of the huge advantages of buying with seller financing. If you purchase all of your properties this way, there is technically no limit to how much real estate you can buy.

Of course, every bank will have an eventual limit (at which point they won't let you borrow any more money from them). But if you buy every property with seller financing (and if each loan is a silo, where the collateral of each loan is limited to the subject property itself), you can keep buying more properties infinitely—provided your sellers will agree to this kind of arrangement.

On the flip side, if I'm selling a property with seller financing, there may be some unique cases where I might ask for a personal guarantee, but this usually isn't the starting point.

When I'm buying a property with owner or seller financing, I would avoid signing a personal guarantee unless there was simply no other choice.

Partial Release of Collateral

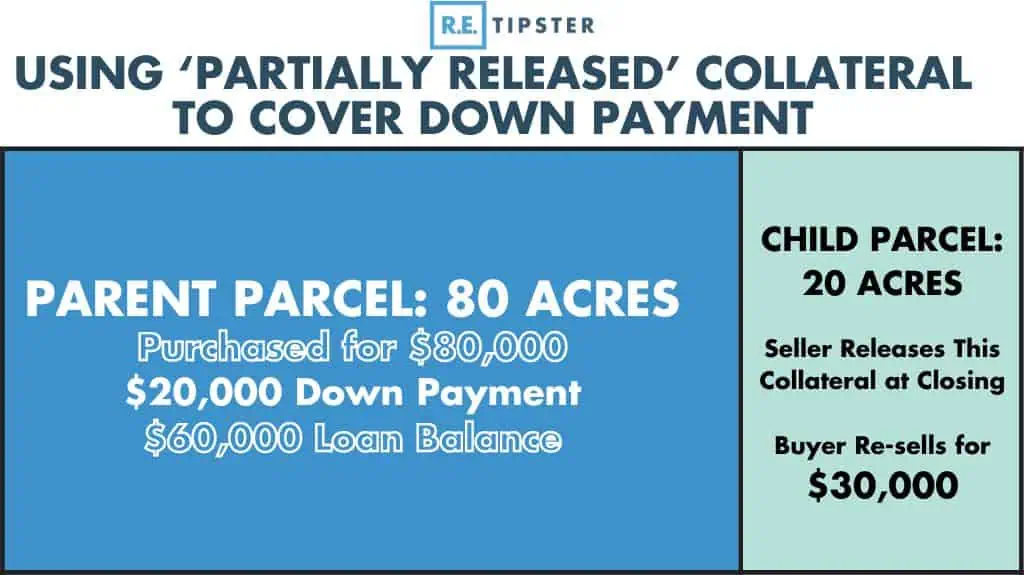

The objective behind this term is for the seller to release a corresponding portion of the subject property from their collateral as the borrower pays down the loan.

This kind of “partial release” arrangement makes a lot of sense when buying a portfolio of properties or a large parcel of land that can be subdivided so that the developer can sell off child parcels one at a time.

Why?

For the seller to release a portion of the collateral, the collateral must be easily divisible.

The strategy behind the partial release allows the buyer/borrower to sell off a portion of the collateral, and the end buyer can then buy this property without any mortgages or liens from the seller-financed loan. If the original seller agrees to a partial release of collateral like this, the borrower (YOU) can sell off some of the property at a profit, and these end buyers will be able to buy them with a clear title.

If you're working in the subdividing game and buying the parent parcel with seller financing, including this provision in your loan documents is crucial!

At the same time, if you're ever buying a property with seller financing that requires a large down payment (whether the seller requires it or you choose to put the money down), you could try to get a corresponding portion of the property released from the seller's collateral.

If the seller agrees to this, you could take that released portion of the collateral, sell it at a higher price, and then recoup your entire down payment, maybe even more!

This is another way to achieve a “no-money-down” deal because your down payment is reimbursed after the released collateral is sold.

Splitting the Loan Into Two Notes

Most people assume that to close a seller-financed deal, all the debt must be tied into a single note. This may be the norm when working with a bank, but with seller financing, you could split the loan into two notes, with one note in the first lien position and the other in the second.

Why would we do this? What's the advantage of setting it up this way?

If you know how to arrange it, this could allow the seller to get a substantial cash down payment, but you won't have to fork over your own cash at closing.

Let me explain.

Say you're buying a property for $100,000. You want the seller to finance 100% of the purchase price (the entire $100,000 amount) through two separate notes:

- Note #1: 1st lien position for 25% or $25,000 of the purchase price.

- Note #2: 2nd lien position for 75% or $75,000 of the purchase price.

Why would the seller agree to this? What's in it for them?

When you set up both notes this way, you can explain to the seller that once the transaction is closed and both notes are fully executed, you will help them find a note buyer, so they can sell Note #1 to another investor.

Once a note buyer is found (and preferably, you'll be able to find them before the deal is even closed), the seller won't have to wait around to collect this money from you!

When this note is sold, the lender/seller will receive approximately 80% of its value, a common discount when selling notes. That's $20,000 cash in their pocket today instead of waiting for the loan to term out, which could take many years to happen.

This gives the seller a 20% cash down payment, but the key difference is that the cash didn't come from you; it came from the note investor, whom you helped find.

When you connect a note seller with a note buyer, you could also earn some fee income for brokering the deal! Check if a broker's license is required for this in your state.

Note: Some states require a license to broker notes like this. In this line of business, brokers will usually charge 1% to 2% of the sale price, payable by the seller with a minimum fee. Check if a license is required in your state before you go down this road.

Also keep in mind this is just extra icing on the cake and not required to accomplish the main objective in this scenario, which is to get the seller paid with cash that isn't coming from you.

Of course, you'll still owe the full $25,000 for Note #1 to the new note investor. This maneuver didn't erase your debt, but it DID allow the seller to get a 20% down payment, and most importantly, you didn't need to come up with the cash!

Pretty cool, huh?

This is a great strategy to help the seller get the cash down payment they want, even when you don't have the cash available to cover it.

Assignable, Assumable, and Wrappable Security Agreement

In every seller-financed deal, there is a Note and a Security Agreement. Both documents are crucial but serve different purposes and contain different information.

The Note focuses on the financial aspects of the loan, such as the loan amount, interest rate, repayment schedule, and maturity date. It is essentially a promise to pay under the agreed-upon terms but doesn't include the protective clauses and details about the property that the security agreement does.

The Security Agreement is the enforcement document that gives the lender the right to seize specific assets if the borrower stops paying. In real estate, the Security Agreement is usually either a Mortgage or a Deed of Trust. It includes information such as:

- Loan Amount: This figure should match what is detailed in the note, ensuring consistency across all documents involved in the transaction.

- Address and Legal Description of the Property: The security agreement provides a detailed address and legal description of the property being used as collateral for the loan. This includes boundaries, dimensions, and other legal identifiers that make the property unique, so there is no confusion about which property is included in the lender's collateral.

- Terms of the Security Interest: This outlines the lender's rights to the property if the borrower defaults on the loan. It outlines the process of foreclosure or taking possession of the property.

- Covenants: These are legally binding promises or conditions that the borrower agrees to abide by as part of the agreement. They can be “affirmative” actions the borrower must take, like maintaining the property and paying property taxes and insurance on time. They can also be “negative” actions the borrower must refrain from, like altering the property in a way that could reduce its value or taking out additional loans secured against the property.

When drafting a Security Agreement, it can be a huge help if it is made to be Assignable, Assumable, and Wrappable.

Assignable: When a Mortgage, Deed of Trust, or any other Security Agreement is assignable, the lender (the note holder) can transfer their rights and obligations under this agreement to another party. In other words, it allows the lender to sell the note to another investor. This allows them to liquidate the note for cash before the term of the note is up, which offers them liquidity and the ability to reinvest in other opportunities.

Remember when we discussed breaking up the loan into two notes? An assignment clause in the note will allow the seller to sell the note like this. It's even more beneficial for the borrower (you) if it includes a first right of refusal, which will give you the first shot at buying the note at a discount (see above).

Assumable: If a Note, Mortgage, or Deed of Trust is assumable, a different buyer can take over (hence, “assume”) the remaining payments on the loan under the same terms and conditions as the original buyer without securing a new loan. This is particularly appealing in an environment where interest rates are rising because it allows a new buyer to benefit from the original financing terms, which might be more favorable than current market rates.

From the buyer/borrower's perspective, this gives you another potential option to dispose of or sell the property in the future. Especially if the financing terms of your seller-financed purchase are more appealing than what banks can offer in the future (and they probably will be), this will make the property. Its financing package will look far more appealing if you ever need to sell it before paying off the loan.

Wrappable: A wrap-around mortgage is useful when buying a property with owner financing, especially when the seller already has an existing loan in place.

Suppose you're buying a house and the seller agrees to seller financing, but they still owe the bank $50,000. In this situation, that $50,000 bank loan would have a superior or first lien position. In other words, if there were two or three lenders who all had a claim to the property, whichever one is the first lien position would have the first shot at taking the property as their collateral to satisfy their loan amount before any other lender does. First lien position is the safest and most secure spot to be in.

Now, let's say this seller with the $50,000 bank loan gives you a new loan to buy their house from them. This new loan can be structured to “wrap around” the seller's existing loan. This means that as you pay the seller, the seller agrees to use part of that money to pay their mortgage to the bank for their $50,000 loan, and they can keep the rest.

Now, the seller would probably be doing this anyway because as long as they still owe money to the bank, they'll have to keep making their payments, regardless of what else they're doing in the background.

When a mortgage or deed of trust is written to be ‘wrappable' like this, it ensures (in case of any confusion) that everyone knows how the payments should work. It clarifies that the buyer knows they are making payments to the seller, not directly to the bank. It also outlines the interest rate, payment schedule, and any other terms agreed upon for the seller-financed loan, and it can provide some legal protection for both the buyer and the seller to make sure the seller uses the payments to keep their mortgage with the bank up to date.

Perhaps more importantly, it means that you, as the buyer, have the freedom to sell the same property to another person with owner financing while you continue making payments to the original seller for their first-position mortgage on the property.

Final Thoughts

As I mentioned, many of these terms can give the buyer a lot of flexibility and control, but even so, many of these things are unconventional and NOT ordinary terms that most closing agents and title companies are used to seeing.

As such, you'll want to get these terms drafted by an attorney in the state where your property is located who understands what you're trying to do and then use whatever title company they recommend.

Also, don't expect the seller to accept every one of these terms. Some may not even be appropriate, given the specifics of your deal and the needs and wants of you and your seller. Either way, the important thing is that you know some of these creative terms you can infuse into your loan documents, depending on what both parties need to make the deal work.