If there's one request I've heard more than anything on this blog – it's from people who want me to put together a GIANT blog post about what my typical land deals look like, sort of like an “Anatomy of a Land Deal”, so to speak.

It's a great idea, and for the longest time I've had every intention of doing this – but given how much time this kind of blog post would take (to closely follow AND document the entire lifecycle from start to finish), I kept pushing it down my list.

Of course, I do explain this process quite thoroughly in the land investing course that comes with a membership to the Land Investing Masterclass, but I also realize, there's nothing quite like seeing a comprehensive case study of a real-world transaction.

So I've made up my mind – it's time to do this.

In this blog post, I'm going to give you an in-depth look at one of my recent land deals.

It basically took me a full year to write this blog post. Why? Because I didn't want to publish this until I had completed the ENTIRE buying and selling process.

Sometimes this process happens quickly (i.e. – within a few weeks), but in this particular deal I'm about to show you, the timeline stretched out a bit longer than normal… because that's just what happens with some deals.

In the end, this deal delivered a solid profit. There were a few bumps along the way, but overall, I think it went fairly smoothly.

As with every deal, new lessons were learned, old lessons were reinforced, and I walked away a little bit wiser about how to handle the future deals I do.

So let's dive in, shall we?

Choosing the County

It all started when I decided to do a blind offer direct mail campaign in New Mexico.

Prior to this, I had never done much work in New Mexico, but I wanted to give this market a good try. I had heard from several other land investors who had done well in the southwestern United States, and I wanted to see what (if anything) I had been missing all these years.

After carefully evaluating 17 different counties from several different angles, I zeroed in on a county that was situated about an hour from Albuquerque.

There were actually several counties in the state that would've been sufficient, but this county had a few good things going for it:

- This county's database was up-to-date (just a few weeks old).

- The county had a very good (and free) GIS mapping system online I could work with.

- The population in this county was well under 100 people per square mile (which meant it was clearly a “rural” county). I was able to verify this through the U.S. Census data.

- Most of New Mexico consists of deserts (as did this county), but this one had a few desirable attributes, like mountains, some small towns, and reasonably close proximity to a big city (so the area wasn't terribly difficult to get to).

- To the extent I could find, there was no urban decay or obvious issues that would adversely affect the livability or desirability of this county.

Again, there were many counties in New Mexico that would've fit a similar profile – but these were the attributes that ultimately made me say, “Yes, let's do it.”

Getting the List

With this direct mail campaign, I decided to download a targeted list of landowners instead of going with the county's delinquent tax list) and I sent out blind offers to each property owner. Essentially, I followed the same basic process outlined in this video:

UPDATE: For years, I used to use a data subscription software called AgentPro247 to generate my direct mail lists. Unfortunately, as of 2022, this service was discontinued and is no longer available. 🥲

What I use now is DataTree, which is more expensive than AgentPro247 was, but it's actually a bit better in several regards (you can do a lot more with it if you know your way around the system). You can also get a BIG discount for the life of your subscription if you sign up through the REtipster affiliate link here.

Another alternative to DataTree, which would be more or less expensive, depending on how you use it, is PropStream. You can learn more about how PropStream works in this series of videos.

Now, in situations where I take the alternative approach of sending out open-ended postcards to a delinquent tax list, I usually need to send out at least 500+ postcards to get ANY notable response.

However, when sending out blind offers to a more general list of landowners, I usually have to send out at least 3x as many units of mail – because on average, these recipients don't have quite the same level of built-in motivation as a delinquent tax property owner.

On the same coin, even though blind offers tend to cost more, they also save A LOT of time, because they don't require the same amount of back-and-forth with each prospect prior to getting an acceptance (and at this point in my career, with more money at my disposal than time, I'd rather save more time than money).

It's also worth noting, blind offers reach BOTH delinquent tax owners and regular owners alike, so I'm not really missing anybody that needs to hear from me, I'm just hitting a lot of other people along the way – some of whom are highly motivated, and some who aren't.

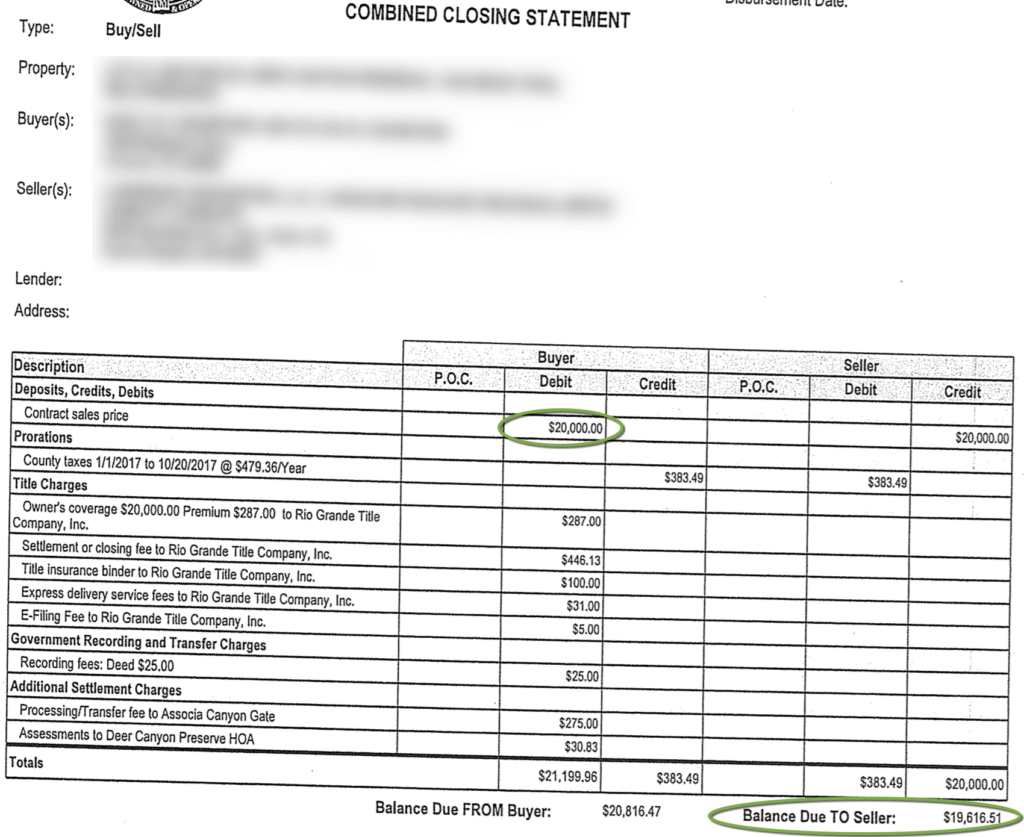

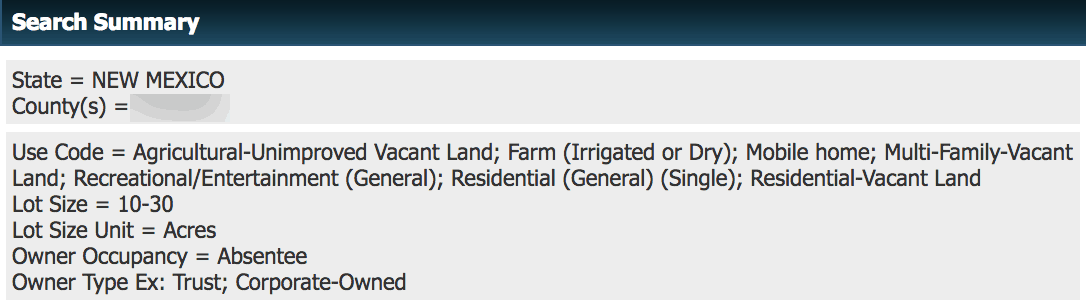

These were the sorting criteria I used to pull my list…

Determining the Offer Price

One of the nice things about this part of the country is that land is relatively cheap (at least, compared to the other markets where I've worked). It's much easier to buy larger parcels of land (20+ acres) for a few thousand dollars a pop – so I decided to target properties in the size range of 10 – 30 acres.

With this price range in mind, I decided to peg the “market value” at $1,000 per acre, and then I formulated all of my blind offers to be exactly 10% of each property's market value.

So for example, if a property was 10.44 acres in size – my equation would calculate this property to be worth $10,440, which meant my blind offer would be 10% of this value (or $100 per acre), putting the offer price at $1,044.

I made offers like this to 898 property owners.

Now, as usual, I like to err on the side of making offers that are too low, rather than too high – so arguably, I could have made offers around $200 per acre and still been within an acceptable range… but since I like to hedge my bets on the lower end, I went with the lower number (and probably lost a few opportunities as a result – but oh well).

Inbound Calls and Acceptances

Within the first couple of weeks, after my offers hit mailboxes, I got 21 responses (mainly in the form of phone calls and emails).

Of all the responses that came in, roughly 1/3 of them were outright acceptances, 1/3 of them were people who had questions about my offer (but weren't really interested), and 1/3 of them were from people calling or emailing to say how much they hated me for sending such a low offer.

Luckily, one thing ended up working out in my favor…

In one section of this county, there was a massive subdivision that had been developed about a decade earlier. Most of the properties in this subdivision were about 20 acres in size, and they were intended for luxury homes ($1M and up). As a result, each lot had been sold to the original buyers at prices ranging from $60K – $80K per lot.

And remember, since each lot was around 20 acres, and my offers were $100 per acre, the contracts I sent out for these lots were around $2,000 per property.

With an acquisition price of around $3K (including closing costs) and a potential value north of $50K… that's a pretty good margin.

This subdivision was at an interesting point in its lifespan though.

Most of the property owners I talked to appeared to be wealthy individuals who lived out-of-state (places like California, Texas, and Pennsylvania). They bought their lots a decade earlier when the subdivision was first developed, and it was sort of a “retirement dream”, with the idea that someday they would move out to New Mexico and build their luxury homes here.

But this subdivision had a couple of issues…

Issue #1

It was governed by a Home Owner's Association, and a fairly expensive one, at that.

Every property owner had to pay the following costs each year:

- $795 – $900 HOA Fee

- $500 for a Shared Well (plus quarterly charges)

- $500(ish) for Property Taxes

…and this was if their property was VACANT. Once they actually built a house on their lot, then the costs would only go up from here.

Issue #2

The water supply available to these properties was extremely hard water, requiring a lot of treatment in order to be potable. It wasn't a deal-killer, but definitely a drawback to building a home here.

These issues (along with the fact that many of these property owners figured out they probably weren't actually going to move to New Mexico when they retired) are probably why I got six acceptances from this subdivision alone.

People were sick of holding onto their property, not doing anything with it, and paying so much money each year – so when they got my lowball offer, time had already done the negotiation for me. They were ready to cash in and be done.

Of course, these higher holding costs made me a little nervous too.

Normally, when I learn that a property is under the jurisdiction of ANY kind of HOA, I run… because the holding costs can eat into my profit margin pretty quickly (and in some cases, it can make the property harder to sell on the back-end).

But then I considered a few things:

- At one point, people were paying $60K – $80K for these lots

- The lowest current listing price in the subdivision was $50K

- I could get up to six of these lots for around $2K – $3K if I wanted them

The downside was – I'd have to cough up a lot more money for every year I owned these things, and if months turned into years, these opportunities could go sideways pretty quickly.

The upside was – if I could sell them in a year or less, it probably wouldn't be hard to make money (and potentially, a lot of money) on each one.

Property Research

Since I knew these properties were in a well-managed, high-end HOA, I was confident each lot was buildable, usable, and livable. Furthermore, since these properties were in the desert, I didn't have to worry about things like flood zones, perc tests, wetlands, and the like. This allowed me to focus more carefully on things like:

- What were the HOA rules?

- What were the annual holding costs?

- What were similar properties listed for on the market?

- Were any of the similar properties selling?

- What utilities were available to this property?

- Was anybody building in this subdivision?

The biggest questions were centered around things like costs, market value, and the demand for these types of properties.

Ultimately, I wasn't able to get much certainty on how quickly these properties would sell (which was a major consideration for whether these deals would be profitable), but all the other questions were answered fairly easily with some quick phone calls and emails to the HOA and county office.

“Cherry Picking”

Since this was a brand new market to me, I didn't know how quickly these properties would sell.

As I noted earlier, I had gotten a total of six acceptances on properties that were in the same gated subdivision. All six of the properties were 20+ acres in size and, and since there were hundreds of similar-sized lots in the same neighborhood (with verified sales numbers within the past decade), it gave me some assurance of what they might be worth.

Also, the presence of utilities, roads, and infrastructure, gave me confidence that they would all be sellable. However, since each lot came with some heavy holding costs, I decided I was only willing to “roll the dice” (so to speak) on a maximum of four lots (in case they all had some unforeseen issues that would make them harder to sell, this would help me mitigate any potential risk, while also limiting the upside as well).

So I basically just picked the four I liked the best and told the other two,

“Due to the higher-than-anticipated response rate and our limited funds, we are unable to proceed with purchasing your property at this time.”

Of all sellers I turned down, none of them responded to me negatively… so that was pretty easy.

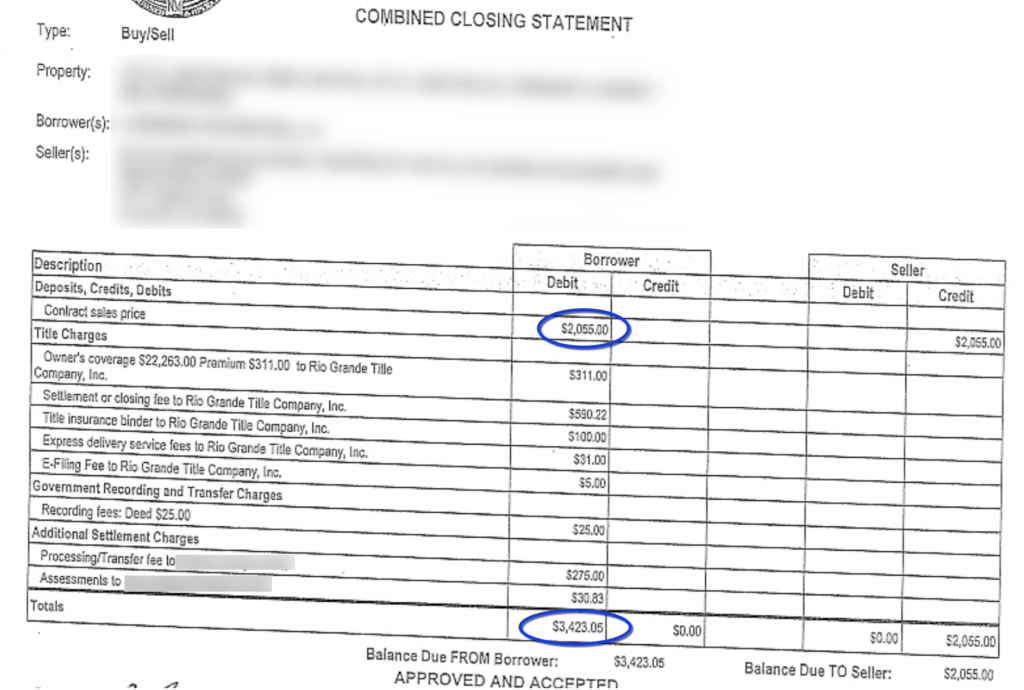

Closing on the Purchase

Since each of these properties had a fairly good profit margin (that is, IF my market value estimates were even remotely accurate), I decided to use a title company to close.

To my surprise, the first title company I spoke with, told me they wouldn't work with me.

Why? Because they were familiar with this subdivision (and the high property values), and they thought something “fishy” was going on with my purchase agreements, simply because the purchase prices were so low.

On one hand, it was comforting to hear some verification that my purchase prices were indeed VERY low.

On the other hand, I was pretty annoyed that they would assume I was a shyster just because the prices were low. Seriously guys??

After stewing in anger for a few hours, I called a second title company and they agreed to close these deals for me… but ONLY IF I paid for title insurance that covered an amount that was closer to full market value (i.e. – even though I was buying each one for a couple of thousand dollars, I had to ensure each one for $20K or more).

It seemed rather petty, but luckily the cost was only about $311 per property, so it wasn't a deal-breaker, and it allowed me to move forward.

Selling

As I feared, these properties turned out to be surprisingly slow to sell.

After paying $800 to a professional photographer from Craigslist to get some great videos and images of each property for me, I put together some great listings and videos showcasing each lot.

Here's one of the videos I put together:

Note: This isn't the original video, I changed the property specifics in this version to be anonymous.

My Marketing Strategy

Since I now owned 4 very similar lots in the same subdivision – it would've been easy to list them all at once, at a very low price.

However, if I had flooded the market with a cheap property like this, it would create a glut of vacant lots on the market, which could (arguably) have a negative impact on the perceived value of every property in the subdivision, including mine.

Instead, I decided to start by listing ONE property at a time. For this case study, I'll refer to this one as “Property A”.

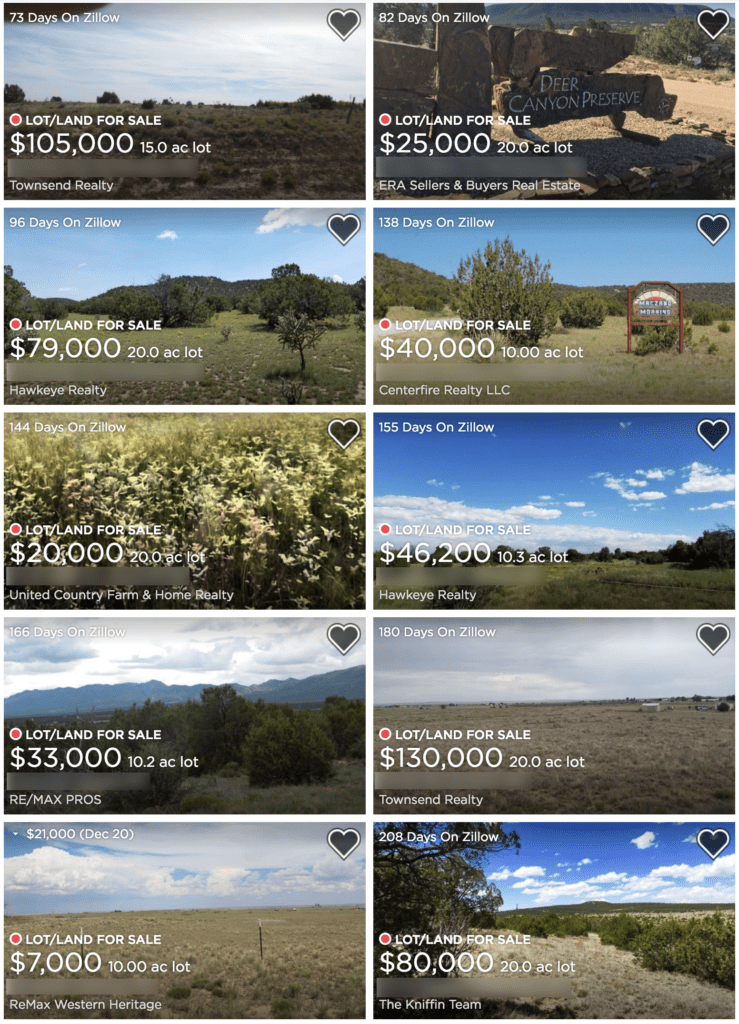

At the time (April 2017), the lowest comparable property listing I could find on the market was listed at $50,000, so I started by listing mine at $49,000.

I posted it on Craigslist, Zillow, my selling website, LandWatch ($34.99), LandandFarm ($139.95), eBay (51.00), the local newspaper ($79.95), a few local Facebook groups, and a six-month listing with Fizber ($349) (Note: Fizber is a site that connects you with a local realtor, and they list it under their name while providing no service other than forwarding you the emails that hit their inbox).

The only sites that got ANY traction were Craigslist and Zillow. Everything else generated absolutely nothing. No leads. No buyers. No tire-kickers. Nothing.

Now, I know plenty of people who DO get results from these kinds of paid sites, but my listing for “Property A” didn't garner anything in this market.

And it gets worse… even the small handful of calls and emails I got through my Craigslist and Zillow listings never developed past the initial contact. For the first couple of months, after a good hard marketing push, people were NOT pounding down my door to buy this property.

Having Patience

Now, I've been in this business long enough to know that EVERYTHING sells eventually, it's just a matter of…

- How long you're willing to wait

- How low you're willing to price it

- What terms you're willing to offer

- How hard you're willing to market

After six months of deafening silence to my marketing efforts, I was starting to wonder if I had made a mistake buying these properties (because remember – each one was going to cost me about $1,800 for every year I continued to own them).

It was around this time that I tried two things that were fairly new and unconventional (for me, at least).

HOA Listing Site

I discovered that this particular Home Owner's Association had a section on its website that was easy to miss.

Essentially, all the property owners in this subdivision who were selling their property could notify the HOA, and then the HOA would link to their online listing, and display all of these links in a dedicated section of their site. This way, if anyone was looking to buy a property specifically in this subdivision, they could see ALL of the properties for sale in one easy place (rather than checking ten different websites and still not seeing everything).

When I figured this out, I sent them the link to my Zillow listing, where my property was listed for $49,000.

About two weeks later, I had an offer to purchase the property for $20,000.

Of course… this was WAY lower than my asking price (and far less than the original market values I was working with), but the beauty of this deal is – it was still 10x higher than my purchase price, and by closing this ONE deal, it would cover ALL of the money I had invested in all four properties AND put a nice profit in my pocket.

Calling Local Builders

I remembered hearing my friend Karl James talk about how he calls up local builders in his market, asks what they're looking for, and makes connections with the properties in his inventory. Since many builders have an understandable need for land to build houses, oftentimes they are happy to buy, quick to close, and easy to work with.

It seemed to work well for him, so I figured I'd give it a shot. I called up the President of my HOA and asked if he knew of any local builders. He gave me the names of two builders, both of whom were based in Albuquerque and had built more than a dozen homes in the neighborhood.

I told both builders they could buy any one of my properties for $10K, because I knew they were local, and would most likely be quick and easy for me to work with. I gave them a link to each listing on my buying website (where they were listed at prices ranging from $49K – $79K). Property A was listed publicly on all the major listing sites, but the other three lots in my inventory (Properties B, C, and D) were only listed on my selling website, so I could show them selectively to the people I wanted to be aware of them.

The first builder said he agreed each property was a great value, but since the market was slower in that area, he wasn't interested in building any spec homes at the moment.

The second builder was still having some hesitancy – even at the $10K per lot price… but if you read to the end of this article, I'll tell you how that conversation panned out. 🙂

Closing on the Sale

Since there was only one title company I could find in the area that was willing to work with me, I decided to run this closing through the same office.

Similar to when I bought the property, the closing process took about a month and required a lot of “jumping through hoops” to get to the finish line (luckily, they dealt with most of this so I didn't have to).

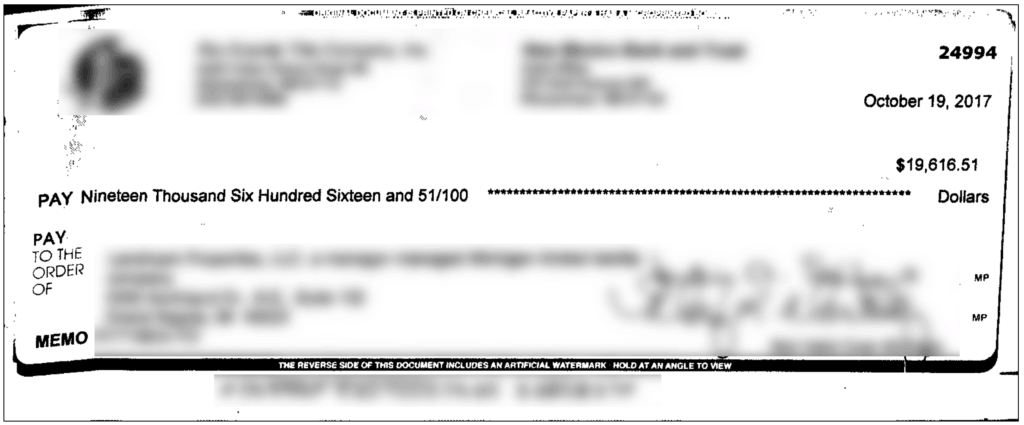

After all that, I walked away with a check for $19,616.51.

I forgot to take a picture of the check before I deposited it, but here's a quick scan I pulled from my bank account (thank you JPMorgan Chase).

When I tally up all the hours of “work” it took me to earn this paycheck (signing documents, posting ads online, answering inquiries, etc), it probably comes out to 20 hours – at the most.

This deal actually required a lot more work than most, because it was a little harder to get sold. On average, I'd say most deals take somewhere in the range of 5 – 10 hours. This one was a little stubborn, but it still paid off very well in the end.

The Final Numbers

So with respect to this first property (Property A), let's take a look at the final numbers:

Purchase Price – $2,055

Closing Costs – 1,368.05

Taxes/Water/HOA – $61.02

TOTAL INVESTMENT – $3,484.07

Sale Price + $20,000

Closing Costs – $383.49

GROSS PROFIT = $19,616.51

$19,616.51 GROSS PROFIT – $3,484.07 TOTAL INVESTMENT – $654.89 MARKETING COSTS = $15,477.55 NET PROFIT

Kind of crazy how I used to work 40 hours a week for roughly 10% of this at my day job… just sayin'.

Biggest Lessons Learned (and Reinforced)

There were a few big lessons and reminders from this deal.

Lesson 1:

It's better to err on the side offering LESS, rather than MORE.

If this property was actually able to generate buyers in the $60K – $80K range, this would have been a deal for the ages… but that wasn't what happened. Instead, the properties generated a buyer in the $20K range, after waiting for the better part of a year.

If I had offered $200 per acre, my profit margin would still exist, but it would've been a lot thinner (and given how much smaller it already was compared to my expectations, I didn't need it to shrink any further).

Lesson 2:

There is BIG opportunity in trying things that are unconventional (hint: like picking up the phone).

If I hadn't been willing to make a few phone calls and put forth more effort than simply posting these properties on Craigslist, I would still own all of them today (and I'd probably feel even more helpless than I did after 6 months of sitting around, waiting for things to happen).

It's easy to click buttons and feel like you're making progress – but when the progress doesn't happen, it's important to be more aggressive. Don't wait for the results to happen, make the results happen.

Lesson 3:

HOA Fees and high holding costs often create big problems for land investors, but they aren't always a deal killer (but in any event, be careful).

Part of what made this property so much less appealing to me was the high holding costs. And since it DID take me longer than expected to sell them, it DID hurt my bottom line.

Granted, I still walked away with a profit of over $16K in the end – but given how much money and time I had tied up in this one deal, it could have been even better.

Lesson 4:

When it comes to marketing and getting your listings noticed – spending money for a paid listing isn't automatically the right answer.

Historically, I've been hesitant to spend money on my advertising, because I know it's usually not vital, and it can easily turn into a bottomless pit (especially when the paid listings aren't producing results).

This situation basically confirmed the issues I've always had with paid listings – because I gave them a whirl on this property and came up empty-handed (while the free methods ultimately ended up making the sale).

Sometimes the things that get results are the things that require thought, creativity and effort, not just more money. Paying for listings could be the answer in some cases, but if they aren't generating results fairly quickly, it may make more sense to simply think outside the box instead of throwing money at the problem.

What do you think? Are there any hidden lessons here I missed? Are there any ways I could have handled this deal differently? Let me know your thoughts in the forum!

P.S. – Remember that second builder I told you about? She agreed to buy the remaining three properties I owned, and it was a relatively fast, trouble-free closing. Remember, it pays to pick up the phone!