REtipster features products and services we think you'll find useful. If you buy something featured here, we may earn an affiliate commission. Your support helps us continue this work! Learn more.

Foreclosure.com is a website that aggregates data from thousands of different sources all over the country (courthouse records, banks, mortgage records, government agencies, etc.) to give you ONE central place where you can find a ton of real estate deals.

Don't get me wrong – there are plenty of other places where you can find this information, but it usually requires looking at a bunch of different sources that aren’t user-friendly, and oftentimes you won’t be able to see every opportunity in one place (e.g., a bank’s list of REO properties will only show you the properties owned by that one bank – not ALL of the foreclosures in the area).

Foreclosure.com gives you a massive shortcut to finding many worthwhile deals in your working markets, so you'll know where to put the magnifying glass.

In this blog post, we'll dive into the details of what this site offers real estate investors, the differences between all the different listing types it offers, and how you can use the site to start finding deals making offers, and making money.

DISCOUNT: If you want to save some money on a Foreclosure.com subscription, you can get a major discount if you sign up through our affiliate link. No pressure, just be aware of this if you think the site would be helpful in your business.

How the Site Works

Remember, Foreclosure.com is just a platform that shows information. They aren't involved with the actual buying or selling process.

Since there are SEVERAL different types of listings you'll find on this site; I thought it would be helpful to put together a quick explanation on each one, along with some notes about what's going on with each type of listing and who you'll need to contact to pursue the deal.

Foreclosure Listings

When you see listings labeled “Foreclosure,” these are typically bank foreclosures (properties that banks have repossessed because the borrower failed to pay). In some cases, these will include HUD foreclosures as well.

In both instances, the properties were purchased with bank or government financing, and the lender foreclosed on the property when the borrower stopped paying.

Since banks and government lenders are not landlords, their primary objective is to sell these properties ASAP so they can recoup the money they lost when their original borrower defaulted on the loan.

Most foreclosure listings will go one of two ways:

- The lender will enlist the help of a real estate agent to list and sell their property.

- The lender will hold an auction to sell the property to the highest bidder.

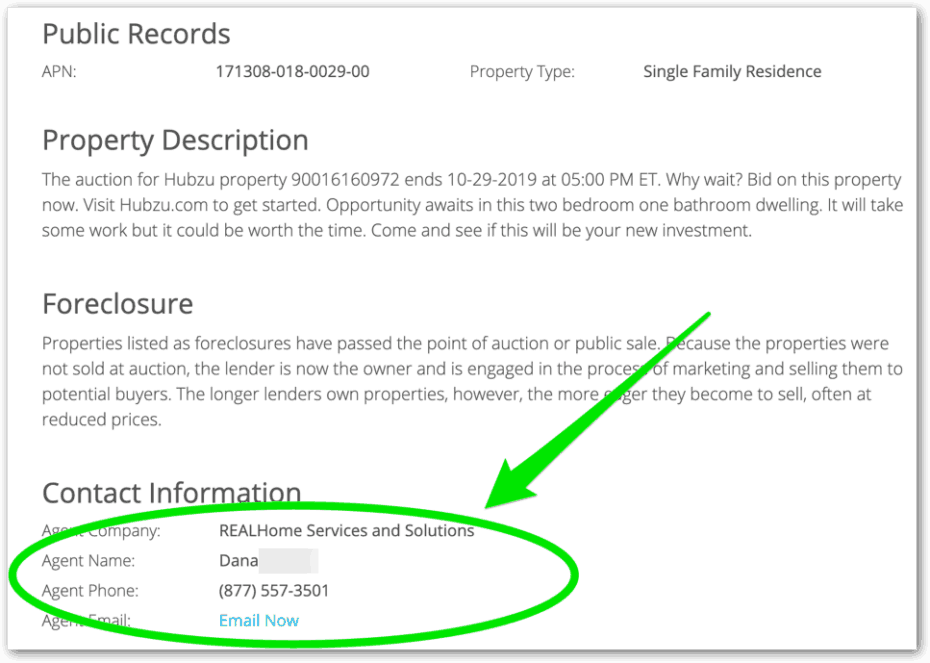

If the lender is working with a local real estate agent, the agent's contact information will be listed on the property's details page.

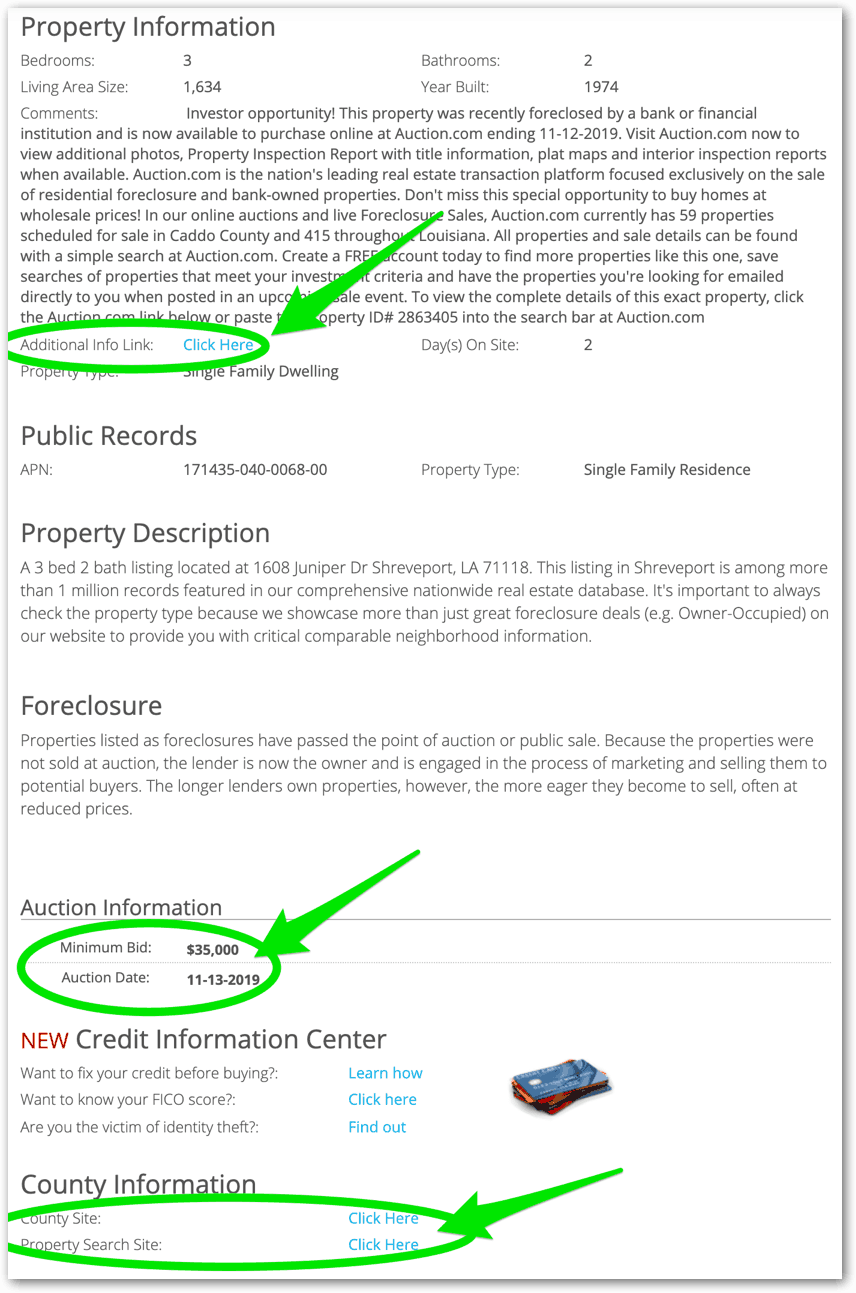

If the lender has chosen to auction off the property instead of listing it with an agent, you'll see some basic auction details and links that will lead you on the right path if you want to bid on the property at the auction.

Note: A lot of states have something known as a redemption period, where the owner can come up with the money and buy the property back AFTER the property has been foreclosed on. Because of this redemption period, many banks and realtors won't even list these properties until after the redemption period has come and gone. In any event, you should be fully aware of how this process works in your state. If your state grants the original owner a right of redemption period, you'll want to know how long that period lasts and whether your targeted properties are still subject to that redemption period.

Imagine buying a property, putting $50,000 of improvements into it and then losing it back to the original owner – all because you weren't aware of their rights to buy-back the property. That wouldn't be a happy surprise, would it?

Get educated about how the foreclosure laws work in your state.

Preforeclosures

Preforeclosure listings are properties that the private owner still owns. However, they are currently delinquent on their loan payments, and if they don't pay them off soon, the lender will seize their property in foreclosure.

As such, when you see a preforeclosure listing, you'll need to contact the homeowner directly if you want to make an offer to purchase their property.

Foreclosure.com does not list the homeowner's phone number because of privacy issues and the no-call list. However, once you have the property information from Foreclosure.com, it's pretty easy to find the owner's contact information if you know where to look (thanks, DataTree). This video explains more…

Skip Tracing Guide: Little Known Tricks to Help You Find Anyone

Preforeclosure begins when a lender first notifies a borrower that his or her loan payments are behind. This notification also details the consequences that occur if payments, penalties, and interest are not paid current.

A common timeline is for the bank to send out this notice within three months of the borrower falling into default, then there is another 3-month window before the bank auction (roughly six months total). However, the specific timeline varies a lot from state to state, so you'll want to get familiar with the start-to-finish timespan that typically applies to the foreclosure proceedings in your area.

In most cases, a foreclosure severely limits the borrower's future credit options. Therefore, if a borrower has no other means to keep the payments up to date, it's in their best interests to sell the property now instead of letting it go into foreclosure.

Sheriff Sale Listings

The Sheriff Sale listings you'll see on Foreclosure.com are essentially Preforeclosure listings. The difference is, when a Preforeclosure listing is also a Sheriff Sale listing, it means the auction date is just around the corner (usually within the next three weeks).

Remember, the homeowner is usually still in control of the property. They can get caught up on payments and get out of it if they have the means to do so (hint: this is an opportune time for an investor to show up and give them the means via a cash offer to purchase their property and in the process, pay their loan current).

Just like the regular preforeclosure listings, if you want to contact the owner and make an offer, you’d have to track them down and see if they’re interested in selling it (see the resources noted above).

Short Sale Listings

When you see a short sale listing on this site, it is usually similar to a preforeclosure situation.

The existing homeowner is typically distressed and eager to sell for less than what is owed on their mortgages. They are “underwater”, and either can no longer afford their mortgage payments or are unwilling to continue making them for various reasons.

On the flip side, lenders are often willing to agree to sale prices that are considerably less than what is owed on the current mortgage because the alternative is foreclosure, which is a costly, complicated and expensive process that will most likely clog their non-performing asset pipeline further.

Most banks are fully aware of this problem, and it may be in their best interests to simply take a smaller loss on the property by selling it to a qualified buyer for a price that is lower than the loan balance owed to them (hence the term “short sale”).

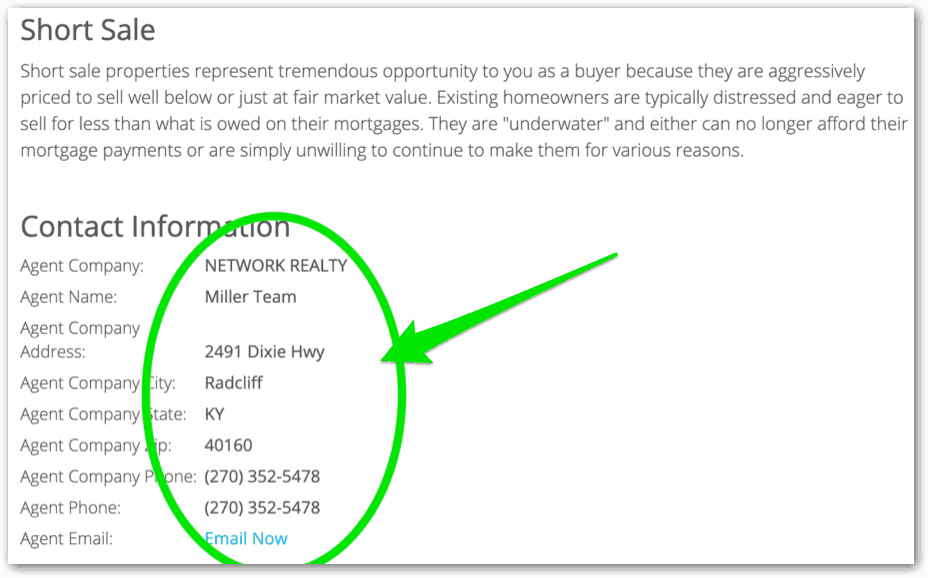

If you want to pursue one of these properties on Foreclosure.com, you'll typically see the contact information for the listing agent – who can walk you through the negotiation and purchase process.

Bankruptcy Listings

Bankruptcy listings are probably the trickiest type of deal to pursue on this website, and there are several reasons why.

When you see a listing that appears as a “Bankruptcy”, it's most likely a privately owned property with an owner who is experiencing financial issues of some kind.

The problem with Bankruptcy listings on Foreclosure.com is, the house itself may have nothing to do with the bankruptcy. Just because you see a bankruptcy listing on this website doesn't mean the house is for sale (for that matter, it may not even be owned by the person who filed for bankruptcy).

It simply means that someone filed for bankruptcy and listed this property as their address in the bankruptcy filing. It could even be that a tenant (or anyone listing this property as their home address) filed for bankruptcy… so, again, these listings are not the most cut-and-dry listings to pursue.

It also depends on the type of bankruptcy filed (Chapter 7 vs Chapter 13). A bankruptcy court case can take up to two years, so even if there is a legitimate opportunity to buy one of these properties, it isn't necessarily going to be a quick process.

City-Owned Listings

City-Owned listings are another somewhat convoluted type of listing on the site because each city offers a whole variety of different programs.

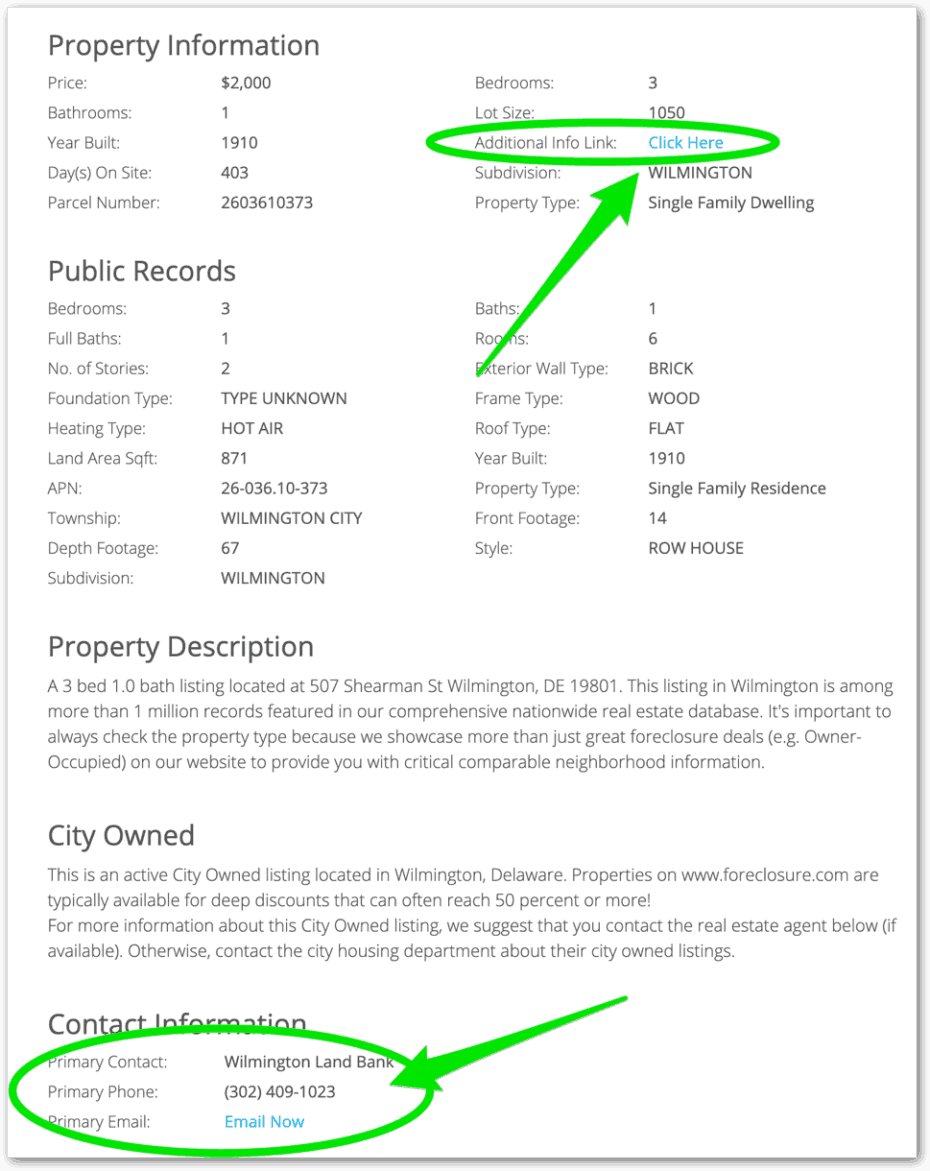

To pursue these listings, you must look at each program and figure out exactly what details are involved. You can figure this out by clicking on “Additional Information” (when this link is available – you won't see it on every City-Owned listing) and/or contact the local office on each listing.

These average real estate investor listings probably don't represent the lowest-hanging fruit. However, suppose you're already familiar with the requirements and programs in the market where you're working. In that case, this can be a great way to zero in on the current opportunities available in your area.

As-Is, Fixer-Upper, and Rent-to-Own Listings

When you see an As-Is or Fixer Upper listing on Foreclosure.com, there is typically no foreclosure involved. These properties are just being marketed for sale (usually through an agent), and since they need help, users might be able to get a better deal on them.

These listings appear on Foreclosure.com because the words “fixer-upper” or “as is” are displayed somewhere in the description's keywords.

Similarly, when you see a Rent-to-Own listing, these aren't foreclosures either. These are shown on Foreclosure.com because the words “rent to own” appear in the description, or the listing was specifically designated as such.

These listings represent opportunities to buy properties without the need for conventional financing. It's also worth noting that there aren’t many properties marketed this way, but any property could be turned into this type of deal IF the owner is willing to offer up this kind of agreement.

Other Helpful Tools

The site also offers email alerts, which can be useful for investors to monitor the areas where they're looking for deals. People can keep an eye on any zip code, city, or county in the United States. These email alerts are free to use.

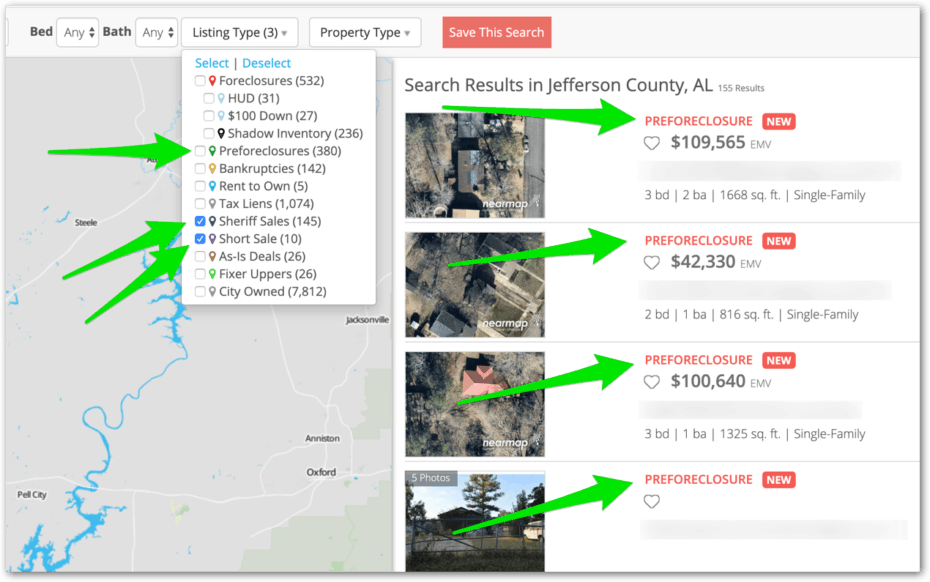

Users can also search for listings based on price, bed, bath, listing type, and property type (similar to how Zillow works, only it focuses on very specific listings). You can also save these searches and receive alerts based on what you're looking for in a given area.

What I Liked

Overall, I think the website can offer a lot of value to real estate investors and deal hunters, but only if they understand the information above and they know how to pursue the types of listings they're interested in (because the process looks substantially different from one listing type to another).

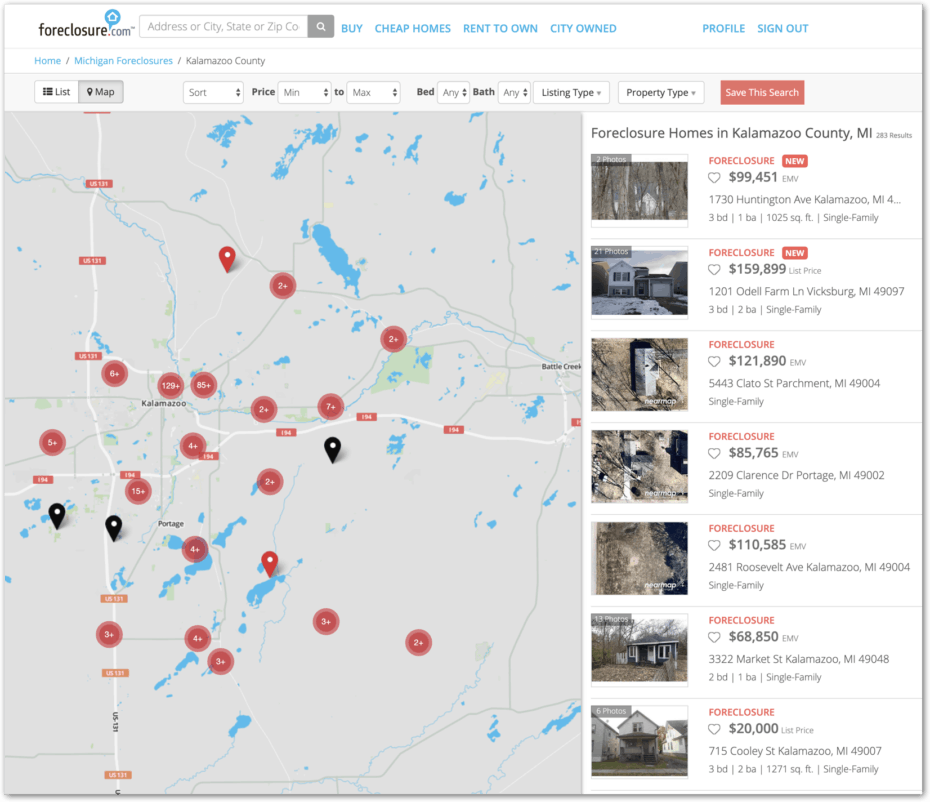

I appreciated the map's layout and how it resembles many well-known sites like Zillow, Redfin, and Realtor.com. Having some built-in familiarity with how things should work is always helpful. I also liked how easy it was to zero in on a specific market area and filter down the various listing types in that target area.

To an experienced real estate investor who understands the dynamics of working with each deal type, this will offer a MAJOR shortcut in finding many otherwise-overlooked investment opportunities… and given the cost of a monthly subscription, I do think it's an incredible value for the money.

If someone is seriously looking for these investment opportunities, I honestly can't think of many reasons why they wouldn't pay for this kind of service. It is a steal at less than $30/mo (through our affiliate link).

What I Didn't Like

As helpful as the site is, I had a few minor gripes.

1. Mapping Functionality: The mapping functionality was generally a little “wonky”. When I was trying to select certain listings (and ONLY those certain types of listings), the map would continue displaying listing types I didn't want to see, which made me feel like I wasn't fully in control of the process and I couldn't always trust what I was seeing on the map. After persisting for a while, it eventually started to work, but not without some consistent effort.

2. Listing Labels: I also had a lot of confusion over how some listings were labeled. For example, the fact that the “Sheriff Sale” listings were labeled as “Preforeclosure” caused me a lot of confusion… until they explained to me that Sheriff Sale listings ARE Preforeclosure listings; they're just at a different point in the foreclosure timeline. However, to the average person who doesn't understand these nuances, there could be some confusion about overlapping various listing types.

In their defense, it is a complex issue because the different labels overlap. My only thought was to maybe specify in the listing label that it's a “Preforeclosure (Short Sale)” or a “Preforeclosure (Sheriff Sale).”

3. The Accuracy of Data: I wouldn't call this last issue a “complaint,” but more of an issue to be aware of if you decide to use Foreclosure.com.

Using this site, I found that the data is updated daily, but that doesn't mean every listing is updated daily.

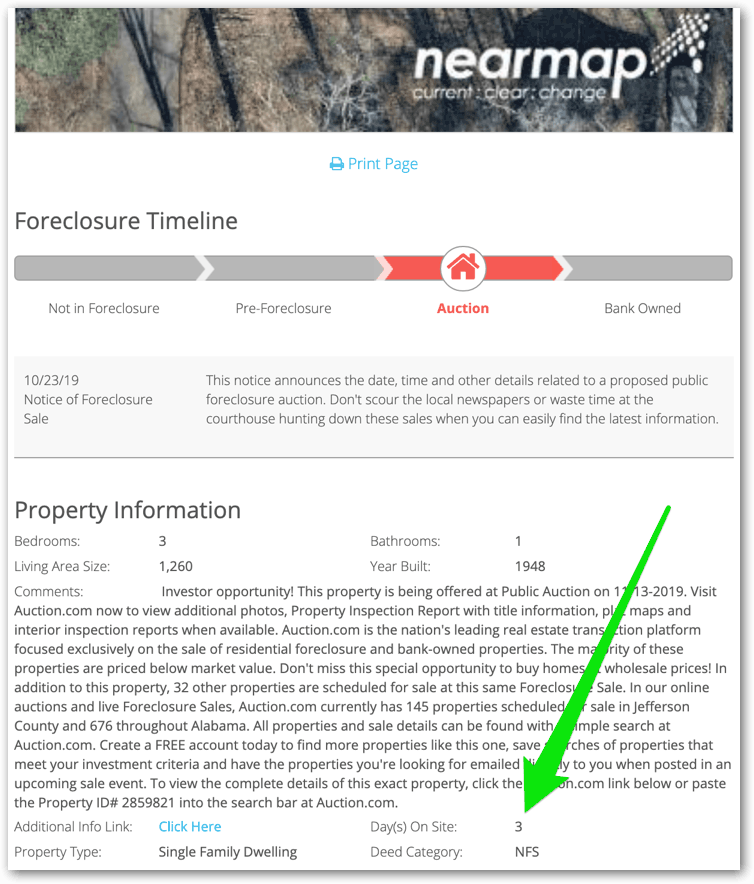

Every listing will indicate the number of “Days on Site.”

Typically, the lower this number is, the more accurate and reliable the listing information will be.

There are some instances where a property might be sold or become inactive – however, the source of the listing information won't send the update to Foreclosure.com about this change. Foreclosure.com simply stops getting information on it, which means the accuracy of the listing information becomes harder to determine. When this happens, Foreclosure.com will leave it on the site for approximately 30 more days before they remove it.

Again, this isn't something I can fault Foreclosure.com for – it's just the nature of running a site where the information is pulled in from TONS of different sources. Not all of those sources are good at communicating important changes to the status of each listing.

Conclusion

I think Foreclosure.com can certainly offer some helpful shortcuts for real estate investors who are actively looking for acquisition opportunities.

When you're not using a one-stop-shop service like this, it can be very easy to miss and overlook these opportunities because most of the free listing sites on the internet (I'm looking at you – Zillow and Realtor.com) aren't designed to focus specifically on these types of property listings.

Despite the minor quirks I encountered with the site, it's still a pretty solid value proposition.

Considering the relatively low cost of a subscription, I think there's a case to be made for subscribing to the site if you're in the market for buying distressed properties.

DISCOUNT: Want to save some money on a Foreclosure.com subscription? Sign up through our affiliate link, and you'll get a big discount as long as you're a paying subscriber!