REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Every so often, I hear from aspiring real estate investors worldwide who are trying to buy and sell properties in the United States from another country.

Some fascinating challenges can come up when you're trying to buy, sell, manage or simply own real estate from another part of the world – especially if you have no intention of actually setting foot inside the United States. Banking, logistics, currency exchange, due diligence, taxes, legal considerations, and language barriers can suddenly become significant challenges.

Depending on several factors, some of these challenges may be easy to overcome. By contrast, others might be more cumbersome – but wherever you're working from, my goal with this article is to help you navigate some of the most common obstacles for those buying and selling U.S. real estate as a foreigner.

Transferring Funds

Of all the issues I've heard from those working outside the United States, this one tends to rank high on the list. It's a multi-faceted issue involving banks, currency exchange, and payment mediums to send and receive funds.

Bank Accounts

Option A: Wherever you're working from, the ideal scenario is to open a bank account in the United States (this will make it MUCH easier to send and receive U.S. dollars quickly from within the country).

In my conversations with bankers in the U.S. – I was told that you do not need to be a U.S. Citizen or have Legal Permanent Resident (LPR) status to open a bank account in the United States. However, most U.S. banks will require you to be at least one of the following things:

1. A Foreign National currently residing in the United States

2. A U.S. Citizen living outside the country

The bank will verify that you meet at least one of these criteria by collecting two forms of identification from you. One of them will need to be a government-issued ID (like a passport or driver's license), and the other can be something less formal, like a Credit Card, Debit Card, pay stub or Rental Agreement showing your U.S. address (if you are not a U.S. Citizen or and LPR). Granted – any bank could have a different set of rules and turn you down… but generally speaking, most banks want your business and will do what they can to help.

Note: Something to keep an eye on is Stripe Atlas. This service can help you set up a U.S.-based company and bank account quickly and inexpensively. For more information on how it works, see this page.

If you are not a U.S. Citizen, do not have LPR status, AND do not reside inside the United States, you will probably find it difficult to get a bank account in the U.S. If you fall into this camp, then let's look at Option B…

Another thing to keep in mind is currency exchange rates. To keep a proper perspective on how far your country's currency is going to go in the U.S., use a simple currency converter to make sure you understand the true cost of what you're buying and selling stateside.

Payment Mediums

Depending on which country you're working from, what currency you're using, and how flexible you're willing to be – you could have several ways to send and receive money in your ongoing business operations.

PayPal

This service can be great for sending and receiving money… the only problem is that PayPal strictly prohibits using their service for buying and selling real estate (which is a bit of a problem since this is our primary method for making money).

I didn't figure this out until 2011 when I asked one of my buyers to pay me $2,500 for a property I was selling. PayPal somehow caught on, and froze the funds in my account until I signed an Affidavit promising never to use their service for any future real estate transactions. I signed the affidavit and regained control of my account, but the event was still a little scary.

Why is real estate such a problem? I'm honestly not sure – but I'd rather be safe than sorry. I don't need a huge chunk of my working capital frozen because I didn't abide by their rules. With this in mind, I don't use PayPal for ANYTHING related to my real estate deals. I don't use it to send or receive earnest deposits, monthly payments, assignment fees, or handle the outright purchases of real estate.

Bank Wire

The most solid and trustworthy (and least convenient) way to send and receive funds is through a bank wire.

Sending a bank wire to another person's account (domestic or international) usually requires a small fee. It requires the sender to complete a form detailing the sender's and receiver's information, including their bank account details, country, currency selection, and more (you can see an example of what Citibank's form looks like right here).

It's not hard, but it's also not as simple as clicking a button (like PayPal and Checkbook.io). And after you've done it once – you'll see what I mean.

Bank wires are often used when sending LARGE amounts of cash and/or transferring funds between banks from different countries. When closing on some of the larger properties I've bought and sold, I've used them on a few occasions.

Automated Payment Collection

If you're looking for a way to collect ongoing payments for a property (e.g. – rent payments, lease payments, or even loan payments in a seller financing situation), there are a few services that have made it significantly easier to collect monthly payments in a completely automated fashion.

To learn more about ZimpleMoney, check out this blog post.

Logistics

Nowadays, making offers and sending Purchase Agreements digitally is easy (without the need for “snail mail”). However, there are still many cases when it's crucial to have original copies of the documentation (e.g. – Deed, Certificate of Trust, Death Certificate, Power of Attorney, etc). Many counties still require original signatures with “wet ink” to record these documents, and in these cases, digital signatures are NOT acceptable You simply can't rely on email for everything.

If you're working with a title company to close a deal, they will take much of this logistical legwork off your plate – but if you're trying to close a real estate transaction in-house, this can be even more labor intensive for someone who is out-of-the-country.

If you're trying to handle the transportation of original documents and signatures, there are a few different ways you can manage this from afar (and a few alternative ways to approach the situation altogether).

1. Using Mobile Notaries and Foreign Notaries

When you need documents signed and notarized in the United States, several mobile notary services can be hired to facilitate this process (usually for less than $100 per job). Many of them will meet with your buyer or seller in the states, obtain all the signatures you need, deliver/receive any cashier's checks or other original documents on your behalf AND notarize any signatures that require notarizing.

Keep in mind – a mobile notary is NOT the same thing as a professional closing agent from a title company or real estate attorney's office (i.e. – they can't verify the accuracy or completeness of the documents or packages you're sending back and forth), but if you simply need some “feet on the street” to act as a liaison – these paid services can be extremely helpful.

One service that may be useful for this purpose is Thumbtack or 123Notary.

Also, note – when it comes time for YOU to sign documents that require notarizing (like Deeds, Affidavits, and Memorandums), you'll need to get these documents notarized, but you won't necessarily need to use a U.S.-based notary. In my conversations with several county Recorder's offices around the country, ALL of them told me that when a foreign citizen gets a document signed in their country of origin, they can use a notary based in their country.

I found this surprising because it’s not always easy to verify the legitimacy of a notary outside the United States – nevertheless, that was the answer I consistently received. The only caveat they added was that if any part of the notarized document were written in another language (e.g. – the notary block, the notary stamp, or even the entire document itself) – these portions of the document would need to be accompanied by an “Affidavit of Translation”, so the county Recorder would be able to understand what the entire document says.

2. Use a Title Company or Real Estate Attorney

Closing a real estate transaction in-house can save you a good chunk of change if you're pinching pennies, but it also involves a lot of extra work (along with the potential for error). When you outsource this work to a qualified title company, this will take the whole “logistics” hassle off your plate (since they should be handling ALL of the back and forth communication between you and the other party). They'll also ensure everything is being done right – which can be a HUGE mental burden off your mind (especially if you don't know what you're doing).

Even though I know how to deal with the complexities of most closings… when I'm working on a property with a market value of $10K or more, I always hand these closings off to a professional closing agent. Just from the standpoint of “time-saving”, it's a no-brainer!

3. Understanding When (and When Not) to Use Digital Signatures

We now live in an age where digital signatures make it MUCH more convenient to get documents signed. Services like PandaDoc and DocuSign (among many others) have brought this technology to a new level, allowing users to quickly and conveniently get legally binding and recognized signatures by the U.S. government.

These services offer great speed and convenience for those working outside the U.S. who need documents signed quickly and easily (WITHOUT waiting for 3 – 4 weeks for papers to go back and forth through the international postal system).

However, it's important to realize that even though the federal government now recognizes digital signatures, many individual counties are not necessarily on the same page yet. In my conversations with the county Register of Deeds offices in my state, none of them would accept digital signatures for recording (they could only use the original copies with “wet ink”).

This doesn't necessarily mean you can never use digital signatures for your deeds and other recordable documents. However, it's worth noting that these digital signature services are still not a viable solution in many cases (and before you go down this road, you'll want to check with the county office to see what they'll allow). Hopefully, this will change in the coming years, but as of now – many counties still seem to be behind the times.

4. Use UPS or FedEx

If you're in a situation where you need to send or receive documentation yourself – it always helps to use an official (and sometimes expensive) UPS or FedEx envelope. This doesn't just help to speed up the transportation of your documents, it also helps your recipients to take you seriously.

For most people, when they receive an envelope like this in the mail…

THEY'RE GOING TO OPEN IT.

This kind of envelope immediately tells send the recipient a message that says “This is important.” or “Someone spent $20+ to send you whatever is inside the envelope, so open it up!“

If you're curious how long it will take and how much it will cost to send a package to/from your part of the world – you can find out with the UPS Calculator or the FedEx Calculator.

5. Use a U.S. Based Mail Service and Address

They'll even go so far as to mail the physical copies to your location (say, if you need an original copy of a deed or cashier's check). The benefit of this is that to your recipients; it removes one of the most obvious clues that you're not working from within the United States.

RELATED: Traveling Mailbox Review: Here's Why I Switched

6. Use a U.S. Based Phone Number

Whether you're using a paid service like OpenPhone, or even a free one like Google Voice – just about every virtual phone service will allow you to establish a phone number with an area code based anywhere in the United States.

RELATED: How to Set Up Your Phone System

Even if you're working from within the U.S. and you want to appear as though you're calling from the market in which you're working – you can still use a phone number based in the area in the area code of your choice.

7. Over-Communicate

Whatever you decide to do, I cannot over-emphasize the importance of communication. Don't assume the other party will understand what's going on.

For example…

- If you decide to close a transaction with a title company, call and/or email your buyer or seller and let them know!

- Alternatively, if you decide to close the deal in-house, call and/or email your buyer or seller and make sure they're fully informed about what the next steps are (and when they can expect to receive the documents from you, and what to do once they're complete).

- If you decide to hire a mobile notary, call and/or email your buyer or seller and let them know who the mobile notary is, and when/where they can expect to meet up with them to close the deal.

See what I'm saying? No matter where the deal is at, no matter how long it takes to reach the next step, or whose job it is to make the next move – you should constantly have your finger on the pulse of what's happening and make sure every party fully understands what is expected of them and when it's expected by.

Due Diligence

The good news is – if you have a phone and a computer, this process can be just as easy for you as it is for me.

I almost never leave my house to do property research these days. When I'm buying vacant land, it's as easy as hiring a service like WeGoLook to prepare a simple property inspection report – and when I'm buying a rental property, I work with a company like HouseMaster to prepare an extremely detailed report, telling me everything I need to know about the property before I invest my money.

You'd also be amazed at how much information is at your fingertips with some of the real estate data services in the U.S. – and with free tools like Google Earth. For an overview of how I do much of my basic property research from afar, you might also find this blog post helpful.

RELATED: The Virtual Real Estate Investor's Toolbox

Language Barriers

Depending on what your native language is (even if it's English), there are two aspects to think about when it comes to “Language Barriers”.

1. Spoken Word

Those who reside in Canada, the United Kingdom, Australia, New Zealand (and even those who have been trained in English since childhood) – chances are, you won't notice any significant verbal communication barriers as you're speaking over the phone with those in the U.S.

If you're someone who speaks English as a second language and you have a heavy foreign accent (which is somewhat of a subjective thing), this isn't necessarily a “problem” per se, but it may be an issue if people in the U.S. find you difficult to understand.

Even if this is a known issue, it won't necessarily be a deal-breaker, but if you aren't fluent in speaking English, there may be times when you'll have to speak very slowly and repeat things until understood.

You'll most likely find that it's okay – most people will be patient and will try to understand you (and even if they aren't patient, don't take it personally – they may just be having a bad day). As with anything, the more conversations you have in English, the better you'll get at it, so keep at it!

2. Written Word

Even amongst my friends and colleagues in the U.S. – I'm always surprised at how many people send horribly-written emails (e.g. – incomplete sentences, bad grammar, missing words, improper spelling, failing to explain points in clear detail, etc).

It's not enough to simply speak the language; you need to be able to communicate your message with clarity and tact in a way that is easy for anyone to understand. Most people can do it, but even for me – it takes time and thought to write well.

The funny thing is, I've had interactions with people in Japan, Mexico, Brazil, Russia, Sweden, Germany, Nigeria, Ethiopia, Trinidad and Tobago who were FAR better writers than some of the “home-grown Americans” I work with every day… so wherever you come from, always be sure to take your time when crafting your written communication. Never underestimate the power of a well-written message.

Writing effectively is a major asset that will serve anyone well in the real estate business. Even if you're not an expert at speaking English yet, keep working on it, and don't forget that you can go a LONG way by simply taking your time and writing a clear, easy-to-understand email, letter, or postcard.

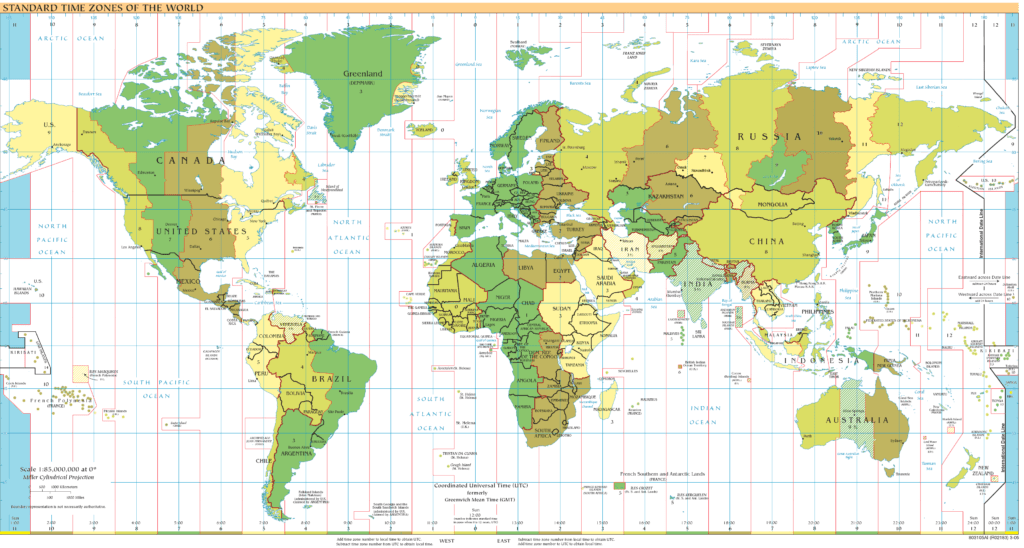

Time Zones

This is probably the least pressing issue, but if you're located in a place like Australia, Japan, South Korea, New Zealand (or anywhere on the other side of the world), this difference in time zones can add some challenges when it comes to real-time communication.

If you're running a business like mine, you'll find that most of the ongoing communication with your clients and customers is NOT terribly time sensitive, and much of the back-and-forth correspondence can be done through emails and/or voicemails. That being said – if you NEED to have a live phone conversation with someone in the states, be sure to schedule your day so that you can contact them near the beginning (8:00am) or end (8:00pm) of the day in the North America time zone.

Use this time zone calculator to figure out what time you'll have to get on the phone in order to catch your contact in the states.

Tax and Legal

Whatever type of real estate you're planning to own in the United States, you should always plan to pay property taxes to the city or township where your property is located.

Additionally, if you're going to earn any ongoing rent revenue from the property, you should also plan to file a U.S. tax return to pay state and federal taxes as well. If you have a typical rental property, you should be able to take advantage of the standard tax deductions (like depreciation and interest expense) to minimize your taxable income. This is why it's important to hire a competent tax professional in the U.S. – as they can help you handle this process the right way.

Owning U.S. Real Estate as a “Foreign National”

If you are a “Foreign National” (i.e. – if you are not a U.S. Citizen and do not have Legal Permanent Resident status in the United States), there are a few things you should know about.

- You DO NOT have to be a U.S. Citizen or have a Green Card (LPR status) to own U.S. real estate in your personal name.

- You DO NOT have to be a U.S. Citizen or have a Green Card (LPR status) to own a U.S. business entity.

- You CAN own U.S. real estate in the name of a foreign business entity.

Although you don't necessarily need to be a U.S. Citizen or have a Green Card to own U.S. real estate, you will be required to obtain an Individual Tax Identification Number (ITIN). The IRS issues ITINs to foreign nationals who must file federal tax reports and do not qualify for a Social Security Number (SSN).

However, you decide to hold title to your U.S. real estate – each of these scenarios will have different tax advantages and disadvantages to consider (some of which is detailed here and here). As usual, if you want to understand the FULL tax and legal implications involved with owning real estate from your respective country (with or without the involvement of a U.S. business entity), you'll have to talk directly with your legal and/or tax professional.

Corporate Formation

Creating your own business entity is easy! If you need a quick walkthrough, I'll show you how to do it in this blog post.

Document Templates

Whenever I'm working in a new state, and I'm not sure what specific language should be included in the contracts and documents I'm working with, I go to RocketLawyer, which is one of the most user-friendly platforms I've ever found for creating legal documents in the real estate business.

Additional Resources

With everything we've covered above, I should clarify that this article is aimed at real estate investors who are planning to be absentee owners (i.e. – those who are buying and selling U.S. real estate for investment purposes, with no immediate plans to visit the country in-person).

If you have other plans (perhaps you'd like to own vacation property or your primary residence in the U.S.), there may be other considerations to keep in mind. For a more all-inclusive look at your situation, be sure to see Zillow's Foreign Buyers Guide – which details many more of the intricacies that can come into play when buying U.S. real estate from another country.